[Reproduced here with kind permission from Jim Cornelius, the author]

Dear Sir/Madam.

I am writing to you in order to point out some egregious errors in the letter sent a few days ago to all MPs by Mr Tim Martin, founder and chairman of Wetherspoons. Mr Martin’s letter complains that during his appearance on the BBC’s Politics Today programme on 17 December 2018, the panellists said his claims were ridiculous. As the evidence I will present here will show, the panellists on the Politics Today programme were right to correct him because he ignores the extent to which tariffs are eliminated through agreements and also the relative level of tariffs applied by the EU compared to many other developed economies.

Overview

Not only is Mr Martin’s claim that 93% of imports from the rest of the world are subject to tariffs factually incorrect, he is also wrong about the tariff applicable to the specific goods he cites in his letter i.e. rice, oranges, wine, coffee and clothes.

Before looking at the measures that eliminate tariffs, it must be understood that all countries with the exception of Singapore, Hong Kong and Macau employ import tariffs.1 New Zealand and Australia liberalised but did not eliminate their import tariff regimes in the 1990s after historically being very heavily protectionist; much more so than the EU2 . Historically, the UK showed preference to Empire trading and immediately before it joined the EEC on 1 Jan 1973, the United Kingdom’s tariffs for goods originating from outside of the Commonwealth were higher than the EU’s Common External Tariff.3 The EU’s agricultural tariffs are lower than that of Norway, Switzerland and Canada and many others.4 If we take into account tariff elimination due to FTAs and exceptions for developing countries it becomes evident that the EU is among the least protectionist markets in the World. On the World Bank index, EU nations are jointly ranked at position 143 (through to 170) out of 177, (1st being most protectionist)5 . And as I understand it, the Dept of International Trade has no plans to change the tariff regime inherited from the EU after Brexit as this would immediately abandon most of the leverage this country would need in order to make free trade deals with other countries so that they reciprocate and lower their own tariffs.6

Trade Agreements

Under GATT Article I, members of the WTO must treat all other members with equal favour so that no one country experiences a higher or lower tariff than any other. But GATT article XXIV states that countries that enter into a free trade agreement or a customs union can eliminate tariffs without prejudicing Article I so long as the tariff elimination covers substantially all trade between the parties in question. Developed countries may also apply tariff reductions to developing countries under the General System of Preferences (GSP).

The EU has free trade agreements (FTAs) with more countries (69 including the recent Japan deal) than any other trade bloc or country on the planet.7 Furthermore, the EU offers developing countries the most generous preferential trading schemes in the World. Under Everything But Arms (EBA), which applies to the 49 least developed countries, tariffs are entirely eliminated for all goods except weapons. Under GSP most tariffs are eliminated and many significantly reduced.8 FTAs and preferences for developing countries mean that imports from 135 sovereign countries are mostly free of tariffs. As a panellist on the programme pointed out the EU itself is the largest free trade area in the world. If we also take these tariff eliminations due to FTAs and exceptions for developing countries into account it becomes evident that the EU is among the least protectionist markets in the World.9

Specific Goods

I now turn to the specific goods cited by Mr Martin in his letter: Rice; oranges; coffee; wine; clothes.

Rice

Under EU Regulation EC 972/20061 0 unlimited quantities of basmati rice from India and Pakistan may be imported into the EU entirely free of duty. The amount of rice imported under this scheme amounts to about 450,000 tonnes annually, which is approximately half of all rice imports to the EU and the majority imported into the UK. Of the remainder, approximately 300,000 tonnes are imported from Cambodia, Myanmar, Guyana, Surinam and several other countries tariff-free due to FTAs and the aforementioned schemes for developing countries. 11

Oranges

With regard to oranges, we have free trade agreements with South Africa (which, being in the Southern Hemisphere, supplies the EU outside of the European citrus season), Egypt, Israel, Morocco, Tunisia, Peru and Mexico. Due to these arrangements, imports from these countries almost entirely tariff-free (or rarely subject to tariffs under the Entry Price System).12

Coffee

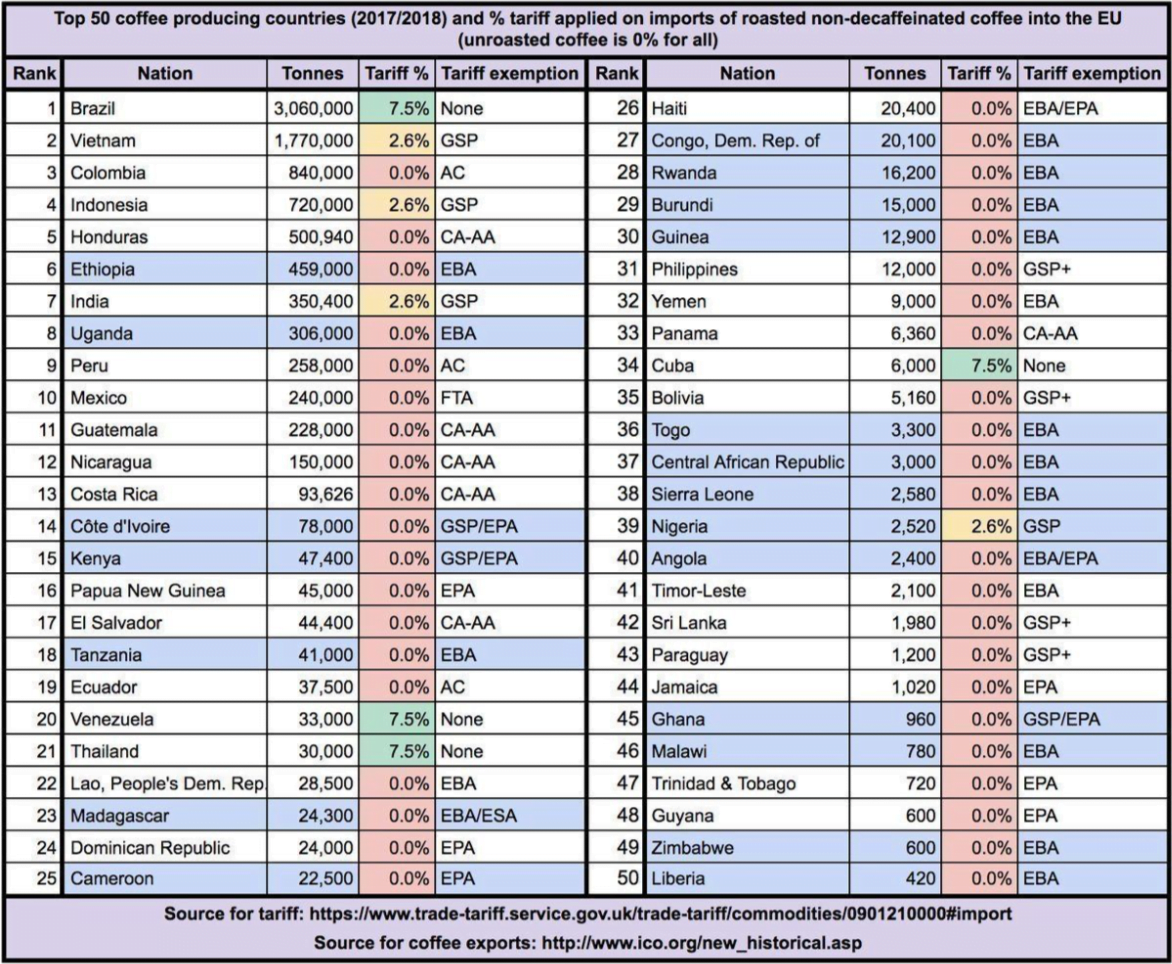

There are no tariffs on green coffee beans.13 While there is a tariff of 7.5% on roasted coffee beans it is entirely misleading to raise it as a concern as there is virtually no inter-continental trade in roasted coffee beans. This is not because of tariffs but because once coffee beans are roasted they immediately begin to lose value and quality. Coffee is therefore generally roasted in close proximity to where it will be consumed. Indeed, for this very reason, Costa Coffee has one of the largest coffee roasting factories in Europe in Basildon.14 In any case, tariffs do not prevent the import of coffee from 42 of the top 50 Coffee exporting countries because those countries benefit from zero duty access to EU markets.15

Wine

Wine from Chile and dozens of other countries is imported into the EU tariff-free and without quota.16 From South Africa, it enters tariff-free under a quota amounting to nearly 150 million bottles per annum.17 New Zealand and Australian wines do have a tariff but its effect on retail price is minimal. For an ordinary bottle of wine with an alcohol content of 13%-15% the tariff amounts to 9p per bottle. 18 This compares with a UK imposed excise duty of £2.16 in 2018, rising to £2.23 on 1 February 2019. That’s 25 times higher!19

Clothing

Clothes are potentially liable to a tariff, but again they are not subject to this tariff when exported by a trade partner. About 60% of our clothing imports come from countries where the tariff does not apply.20 The EU of course, plus Turkey, Bangladesh, Cambodia and Pakistan are the most notable. Clothing manufacture is prevalent in much of the developing world. Bangladesh, for example, supplies around 13% of imports into the UK. About 60% of their clothing exports are destined for the EU. Bangladesh is on the EU’s EBA scheme as a developing country and this tariff exemption allows Bangladesh and other countries benefiting from tariff elimination to compete on the world stage with China and other more prosperous countries.21

Conclusion

Mr Martin’s claims about EU protectionism and tariffs are wide of the mark, and he seems to be given an inordinate amount of time to espouse them on TV without ever being challenged by experts. I hope this letter and the references which follow will help correct that.

Regards

Jim Cornelius

Lewes, East Sussex

@Jim_Cornelius on Twitter.

References:

1. ITC Market Access Map: https://www.macmap.org/supportmaterials/DataAvailabilityMfn.aspx

2. The fall in historic high tariffs in Australia and New Zealand to levels comparable to the UK/EU over the period 1988-2016. https://www.indexmundi.com/facts/indicators/TM.TAX.MRCH.SM.AR.ZS/compare#country=au:nz:gb

3. Prior to its accession in 1973 tariffs on imports into the UK from outside the Commonwealth were higher than the equivalent EEC’s common external tariffs. http://cep.lse.ac.uk/pubs/download/dp0588.pdf (table 2 page 4).

4. Comparing agricultural tariff levels: UK/EU, Canada, Norway, Switzerland.

a. Select country: https://www.macmap.org/CountryAnalysis/AverageTariff.aspx

b. United Kingdom:

https://www.macmap.org/CountryAnalysis/AverageTariffResult.aspx?country=SCC826%7cUnited+Kingdom&bysection=0

c. Canada:

https://www.macmap.org/CountryAnalysis/AverageTariffResult.aspx?country=SCC124%7cCanada&bysection=0

d. Norway:

https://www.macmap.org/CountryAnalysis/AverageTariffResult.aspx?country=SCC757%7cNorway&bysection=0

e. Switzerland:

https://www.macmap.org/CountryAnalysis/AverageTariffResult.aspx?country=SCC757%7cS witzerland&bysection=0

5. EEC Countries are jointly ranked at position 143 (through to 170) out of 177. With 1 being the most protectionist. Criteria: Tariff rate, applied, simple mean, all products (%): https://www.indexmundi.com/facts/indicators/TM.TAX.MRCH.SM.AR.ZS/rankings

6. House of Commons, International Trade Committee, Oral evidence: “Continuing Application of EU Trade Agreement” transcript of evidence by Lord Hannay and Lord Price. Questions 200-202. http://data.parliament.uk/writtenevidence/committeeevidence.svc/evidencedocument/international-tra de-committee/continuing-application-of-eu-trade-agreements/oral/77283.pdf

7. EU trade deals in force with 69 sovereign countries: Albania, Algeria, Andorra, Angola, Antigua and Barbuda, Bahamas, Barbados, Belize, Bosnia and Herzegovina, Botswana, Cameroon, Canada, Chile, Colombia, Costa Rica, Côte d’Ivoire, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Fiji, Georgia, Ghana, Grenada, Guatemala, Guyana, Honduras, Iceland, Israel, Jamaica, Japan*, Jordan, Kenya, Kosovo, Lebanon, Lesotho, Liechtenstein, Macedonia, Madagascar, Mauritius, Mexico, Moldova, Montenegro, Morocco, Mozambique, Namibia, Nicaragua, Norway, Palestinian Territories, Panama, Papua New Guinea, Peru, San Marino, Serbia, Seychelles, South Africa, South Korea, St Kitts and Nevis, St Lucia,St Vincent and the Grenadines, Suriname, Swaziland, Switzerland, Trinidad and Tobago, Tunisia, Turkey, Ukraine, Zimbabwe. [Japan to be in force from 1 February 2019].

http://ec.europa.eu/trade/policy/countries-and-regions/negotiations-and-agreements/#_in-place

Note: Agreements listed on the website as partly in place include multilateral deals where not all of the partner countries have committed to the agreement. The 69 countries listed above include only those countries that have a complete FTA in place (exception Japan) or countries that are currently benefiting from tariff elimination while other non-listed parties to the agreement are not).

8. Everything But Arms. “The most generous form of preferential treatment to LDCs globally”:

http://trade.ec.europa.eu/doclib/docs/2013/april/tradoc_150983.pdf

9. Report from the World Bank on Preferential Trade. http://documents.worldbank.org/curated/en/655601526483739564/pdf/WPS8446.pdf The graph on page 10 shows EU countries relative low levels of tariffs at MFN level (orange dot) when compared with most of the rest of the world. But as the EU offers significant preferential market access the average tariff is dragged down further still to very low levels (green dot).

10. Zero tariff trade in rice with India and Pakistan:

http://publications.europa.eu/resource/cellar/84682e19-b244-4a60-95a9-3d08df276c3a.0006.01/DOC_1

11. EU Rice imports. Page 12

https://ec.europa.eu/agriculture/sites/agriculture/files/cereals/trade/rice/economic-fact-sheet_en.pdf

12.

a. Egypt: Tariff Schedule for oranges on 21/12/2018 (CN 0805102210). 0% unless EPS

triggered (very rarely).

http://ec.europa.eu/taxation_customs/dds2/taric/measures.jsp?Lang=en&Taric=0805102210& EndPub=&Domain=TARIC&op=&MeasText=&Offset=0&Area=EG&ShowMatchingGoods=&c allbackuri=CBU-1&LangDescr=&Regulation=&MeasType=&textSearch=&StartPub=&SimDat e=20181221&measStartDat=&GoodsText=&OrderNum=&search_text=goods&ExpandAll=true

b. Israel: 0% duty on oranges under a quota of 2,240,000 tonnes (more than double Israel’s annual production according to FAOSTAT ). http://ec.europa.eu/taxation_customs/dds2/taric/measures.jsp?Lang=en&Taric=0805102210& EndPub=&Domain=TARIC&op=&MeasText=&Offset=0&Area=IL&ShowMatchingGoods=&cal lbackuri=CBU-1&LangDescr=&Regulation=&MeasType=&textSearch=&StartPub=&SimDate= 20181221&measStartDat=&GoodsText=&OrderNum=&search_text=goods&ExpandAll=true

c. Morocco: 0% duty on oranges under the Entry Price System.

http://ec.europa.eu/taxation_customs/dds2/taric/measures.jsp?Lang=en&Taric=0805102210&EndPub=&Domain=TARIC&op=&MeasText=&Offset=0&Area=MA&ShowMatchingGoods=&c allbackuri=CBU1&LangDescr=&Regulation=&MeasType=&textSearch=&StartPub=&SimDate=20181221&measStartDat=&GoodsText=&OrderNum=&search_text=goods&ExpandAll=true

d. For other countries see:

https://www.trade-tariff.service.gov.uk/trade-tariff/commodities/0805102210?currency=EUR& day=20&month=12&year=2018#import – note the Standard Import Value is not the tariff, where applicable open up the conditions link to see the tariff.

13. No duty on coffee beans.

https://www.trade-tariff.service.gov.uk/trade-tariff/commodities/0901110000?currency=EUR&day=20 &month=12&year=2018

14. Costa open one of the largest coffee roasteries in Europe in Basildon

https://www.foodprocessing-technology.com/projects/costa-coffee-roastery-basildon-essex

15. The world’s top 50 coffee producing countries and the tariff on roasted coffee exported to the EU.

Note: African countries are highlighted in blue. The figure in the “Tonnes” column is the annual coffee production levels.

16. The tariff on wine is 0% for Chile and many countries importing into the EU

https://www.trade-tariff.service.gov.uk/trade-tariff/commodities/2204219811#import

17. South African tariff-free wine quota:112,118,000 litres (nearly 150 million bottles).

a. Shipped by bottle 78,482,600 litres

http://ec.europa.eu/taxation_customs/dds2/taric/quota_tariff_details.jsp?Lang=en&StartDate=

2018-01-01&Code=091892

b. Shipped in bulk 33,635,400 litres

http://ec.europa.eu/taxation_customs/dds2/taric/quota_tariff_details.jsp?Lang=en&StartDate=2018-01-01&Code=091893

18. Impact of tariffs on Australian wine in the European Union (Australian Grape and Wine Authority):

https://dfat.gov.au/trade/agreements/negotiations/aeufta/submissions/Documents/australian-grape-a nd-wine-authority-eufta-submission.PDF; Table 2, page 5

19. Current and historical excise duty levels for wine:

https://www.wsta.co.uk/images/Budget/2018/Excisedutyratessince2000.pdf

20. UK Clothing imports. 60% tariff-free from the EU and non-EU countries via FTA and GSP/EBA for developing countries. https://www.trademap.org/Country_SelProductCountry.aspx?nvpm=1%7c826%7c%7c%7c%7c62%7 c%7c%7c2%7c1%7c1%7c1%7c1%7c1%7c2%7c1%7c1

21. Trade Benefits for the Least Developed Countries: the Bangladesh Case Market Access Initiatives, Limitations and Policy Recommendations, Department of Economic & Social Affairs

by Mustafizur Rahman (Executive Director, Centre for Policy Dialogue, Dhaka, Bangladesh): http://www.un.org/en/development/desa/policy/cdp/cdp_background_papers/bp2014_18.pdf